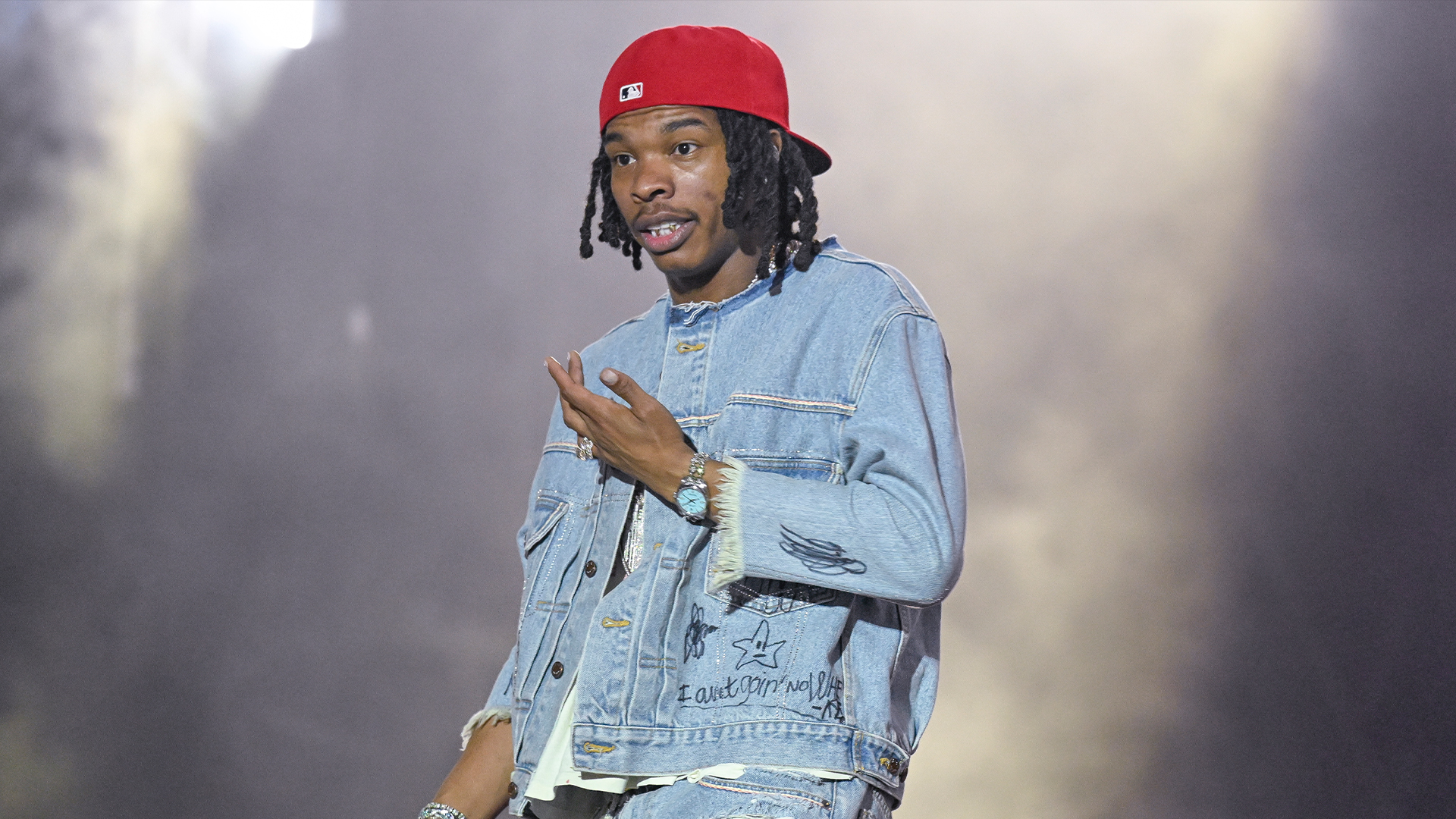

Despite earning millions, Lil Baby did not pay taxes for his first two years in the music industry.

The Atlanta, GA-born rapper, known for chart-topping hits like “Drip Too Hard” and “We Paid,” appeared on the “A Safe Place Podcast,” hosted by Yachty, and discussed the financial learning curve. While he acknowledged having some understanding of investing and saving, he was unaware of the importance of taxes when he first entered the industry. His debut album, released in 2018 under Quality Control Music, marked the beginning of his rise to stardom.

“I done got over $100 million from labels and deals. Not one time nobody still haven’t told me how to pay my taxes. Nobody even never told me pay my taxes,” Lil Baby explained on the podcast. “I always knew from growing up, like from being around, I heard people have tax problems, people don’t pay their taxes. I was doing it so wrong, my first tax bills was so high ’cause I was on some hustling sh-t like saving all my money. The more money I was saving, I owed IRS more money. I didn’t even know you need to be spending this money you need to be spending it the right way. So you can save it on your taxes, you know what I’m saying. I ain’t known none of that, and this is a while ago whenever I started rapping.”

Lil Baby also reflected on his decision to drop out of Booker T. Washington High School, expressing regret and acknowledging that staying may have better prepared him for the financial challenges he faced later in life.

Nonetheless, he is making wiser decisions today. Lil Baby now pays his taxes quarterly and works with accountants, which he says he found by reaching out to industry peers Rick Ross and 21 Savage.