If you’ve been following the stock market in recent days you may already be familiar with SoftBank, a multinational internet services and investment firm operating out of Japan. The business has received a ton of press since Monday morning after CEO Masayoshi Son announced a proposed $100 billion in investments over the next four calendar years. This plan, which was developed in collaboration with the incoming Trump administration, is projected to create 100,000 new jobs within the United States, particularly in artificial intelligence and similar internet-based infrastructure. Per the Wall Street Journal, SoftBank’s stock (SFTBY) received a massive bump in the day following the announcement, accounting for a 4.4 percent rise in the Japanese market and a 1.3 percent rise on the New York Stock Exchange.

To better understand exactly what this means for our country, infrastructure and the stock market of today, we’ll have to take a moment to examine SoftBank’s business model and growth projections and study the legitimacy of the proposed deal with the Trump administration. We’ll also take a moment to analyze the investment firm’s past promises and see what we can learn about Masayoshi Son’s relationship to the once and future president.

What Is SoftBank’s Business Model?

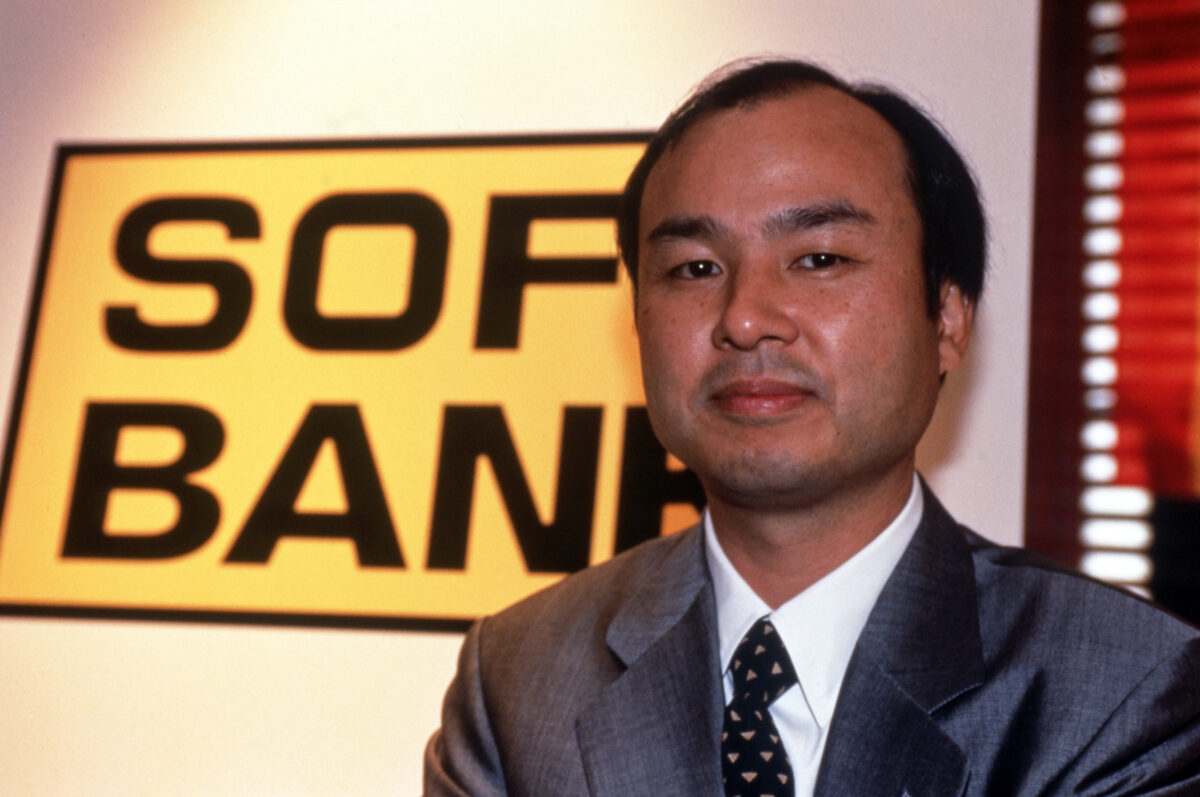

Even if you’ve never heard of SoftBank before, there’s a pretty high likelihood that you’ve actually interacted with a product or service that they fund in some capacity. Since Masayoshi Son first founded the company back in 1981 as a software developer, the business has expanded into various other territories. Today, SoftBank is one of the largest publicly traded companies in all of Japan, second only to Toyota. With partners and financiers from all over the globe, SoftBank serves as a financial backer to thousands of businesses and proprietary tech, including those in fields like robotics, logistics, real estate, hospitality, software development and now even artificial intelligence.

Notably, SoftBank served as one of the earliest financial firms to back Alibaba and currently serves as the majority shareholder in the massive E-commerce company. The investment holdings outlet also retains massive stakes in Arm semiconductors, WeWork office spaces and German telecommunications company Deutsche Telekom, just to name a few. SoftBank recently announced plans to invest more than $1 billion in funding for OpenAI, the company best known for developing the generative AI model ChatGPT. Needless to say, the company is pretty huge, so a pledge of $100 billion invested into the American economy wouldn’t be entirely out of the question. Though little is known about how SoftBank plans to disseminate these funds, nor what specific terms contractors will receive from the deal, day traders obviously see this announcement as a massive windfall, accounting for the uptick in stock prices.

Who Is SoftBank’s Founder And CEO?

Though government administrations often tend to strike deals with large investment firms to stimulate the economy, SoftBank CEO Masayoshi Son turned heads this week with his firm pro-Trump comments made during the announcement of the new deal. Per CNBC, Son specifically said, “I would really like to celebrate the great victory of President Trump, and my confidence level to the economy of the United States has tremendously increased with his victory.” In the short time since the pair went public with their intention to generate 100,000 American jobs, many investors have been voraciously studying Son and his investment track record.

Masayoshi Son currently ranks No. 55 on the Forbes list of World’s Billionaires, touting an estimated net worth of over $33 billion USD, with billions more in equity through his massive ownership shares in SoftBank. Though he touts one of the most impressive investment portfolios in the entire world, Son previously held the distinction of having lost the most money in history, due to a $59 billion loss during the dot com crash of 2000. Elon Musk has since surpassed this distinction with a series of ill-advised financial decisions, not the least of which was his purchase of Twitter.

Unpacking Trump’s Meeting With Masayoshi Son

Per the previously mentioned write-up in CNBC, Son traveled to Trump’s Mar-a-Lago home in Florida to discuss the terms of their upcoming investment. After a pleasant conversation, the pair arrived at the $100 billion figure, as well as the projected growth of 100,000 U.S. jobs, before announcing their intentions to the public. While many investors are feeling quite optimistic about this announcement, some have raised concerns about the likelihood of this financial and economic growth panning out. Son previously met with Trump for a similar deal back in 2016, wherein SoftBank pledged $50 billion and 50,000 new jobs. Like this week’s announcement, the initial press junket for the 2016 deal drew a great deal of headlines, though it remains to be seen if that money or those jobs ever fully materialized.

While addressing the press, Masayoshi Son exclaimed, “President Trump is a double-down president. I’m going to have to double down.” Trump then responded, half-jokingly, that he’d lock Son in for a $200 billion investment. If these funds do clear in full, and these jobs in the field of AI and more are developed, economists will surely hail this move as a universal home run. Unfortunately, there is a non-zero chance that the recent announcement is simply a roadmap for an investment strategy that never fully clears. Either way, artificial intelligence is becoming a larger part of daily life for millions, so new jobs within the AI market seem inevitable.