Showing 31 results for:

investments

Popular topics

All results

Elon Musk, entrepreneur and CEO of companies like Tesla and SpaceX , is not only known for his innovations but also for his staggering wealth. In 2022, Musk made headlines when he invested a whopping $44 billion in X, formally known as Twitter. This move sparked discussions about the investment’s value and impact on the platform. Despite expressing buyer’s remorse and even joking about it on social media , Musk’s financial decisions continue to fascinate the public’s attention. How Much Money Does Elon Musk Make Per Second? Elon Musk earns approximately $656 per second, according to CoinCodex . This estimation is from Musk’s reported estimated net worth of $205.2 billion as of January 2024 and the span of over a decade during which he accumulated his wealth. Musk’s earnings per second are over $43,000 per minute, nearly equivalent to the annual full-time wage in the US of $53,490. Musk earns a year’s salary in just one minute, and it takes him only a week to reach a nine-figure...

When it comes to Hip-Hop success stories, few — if any — are as impactful as Shawn “Jay-Z” Carter. From his early beginnings as a street hustler from Marcy Projects in Brooklyn, NY, to becoming a billionaire mogul with his own Marcy Venture investment firm, Hov has proven time and again that it’s not where you come from, but where you’re going that counts. Plus, he’s married to Beyoncé! The rapper-turned-mogul is such a success, in fact, that the hypothetical question, “dinner with Jay-Z or $500k” has become a part of the pop culture zeitgeist , to the point that Tidal had to put out a statement on Twitter about the phenomenon. Take the $500K. — TIDAL (@TIDAL) September 9, 2021 Iconic. But contrary to popular belief, not everything Jay-Z touches turns to gold. Before he became a billionaire, the man born Shawn Corey Carter lost his proverbial shirt on a bad real estate deal. The deal was so bad, in fact, that it ultimately cost him more than $50 million to get out of. And while he’s...

A new claim by Forbes suggests that celebrity startups may not be what we think they are. The outlet starts out by taking aim at both Rihanna and Kim Kardashian’s recent announcements about their latest funding rounds in their celebrity startups, questioning whether Savage X Fenty and SKIMS (respectively) were really worth the money they’d raised in recent funding rounds (Savage X Fenty raised $125 million in a Series C funding round, while SKIMS raised an additional $240 million, thus bringing its new valuation to $3.2 billion). The outlet also points out that celebrity investments (in other words, what they’ve invested from their personal checkbooks) in their own companies are often not disclosed — and neither are the real sales numbers. “All these private companies are on a PR tear and it’s even easier when a big name is involved,” said Sucharita Kodali, a retail analyst at Forrester, to Forbes. What’s more, she said, company valuations are often inflated by up to ten times their...

Virtual trucking carrier CloudTrucks has secured a $115 million Series B funding round on a reported $850 million valuation, according to Forbes. The Black-owned company was founded in 2019 by Tobenna Arodiogbu, Jin Shieh and George Ezenna. CloudTrucks provides a tech platform that helps small trucking businesses manage their administrative duties, including scheduling, instant payments, expense tracking and more. The startup plans to use the fresh funding to expand its operations across the U.S., grow its team and further build out its proprietary tech. “Nearly every sector of the economy relies on drivers to transport its goods, and we are eager to use this latest round of funding to continue optimizing the trucking business—especially as our country needs new truck drivers more than ever,” Arodiogbu, CloudTrucks Co-founder and CEO, said in a press release.

It’s no secret that the startup world needs more Black investors and venture capitalists. Inc. Magazine reports Black founders are raising “record amounts of venture capital” in 2021, even though they only rang in 1.2 percent of all venture capital in the first half of the year. Last year, Black founders received only 0.6 percent of venture capital (VC) deployed. That’s unacceptable, and Black investors are stepping up to the plate to change that. Some notable Black venture capitalists making major moves in the VC world include Jarrid Tingle, co-founder and managing partner of Harlem Capital; Marlon Nichols, managing general partner at MaC Venture Capital; and Austin Clements, partner at Slauson & Co. The trio will hit the virtual stage at AfroTech 2021 during the “Black VCs: Raising Millions with a Mission” panel to discuss how they are working to raise millions of dollars to diversify venture capital investments. Ultimately, Nichols, Clements and Tingle want to put more dollars in...

D-Nice was responsible for getting most of us through the craziness of the pandemic thanks to his “Club Quarantine” live mixes. Now, the DJ and rapper is looking to get us out of the house and tucked into a nice glass of wine. The Drinks Business is reporting that D-Nice — real name: Derrick Jones — is putting his money where his mouth is with his investment into French wine label Maison Marcel, whose previous investors include LiveNation and multimedia artist James Goldcrown. View this post on Instagram A post shared by Maison Marcel (@drinkmarcel) “We are honored to have an icon like D-Nice as an investor. His passion for celebration and togetherness speaks directly to the ethos of our brand,” said Albert Dahan, CEO of Maison Marcel, in a statement to the outlet. “Not only does he have refined taste, but his finger is on the pulse of culture in a unique and broad way. His organic affinity for our wines was a clear sign we were doing something right. A deeper partnership was the...

Ryan Leslie could teach us a thing or two about investing in stocks! The iconic singer/songwriter/producer, responsible for hits like Cassie’s “Me & U,” is also quite the entrepreneur and businessman with an eye for investments. Leslie must’ve known that Apple would become the tech giant that it is today, having first invested in the company back in 2009. In 2018, Apple became the first trillion-dollar company. According to Complex, the “Addicted” singer’s initial stake of $100,000 reached millions of dollars thanks to a wise lesson from his mentor. View this post on Instagram A post shared by Earn Your Leisure (@earnyourleisure) Leslie detailed exactly how during an episode of the “Earn Your Leisure” podcast stating: “I remember a conversation I had with my mentor. I said, ‘Hey look, man. I took your advice and man, $100,000 to $350,000. I’mma cash out and get something nice for my mom.’ And he gave me the ultimatum at that time– he said, ‘Ryan,listen. You can go ahead and cash...

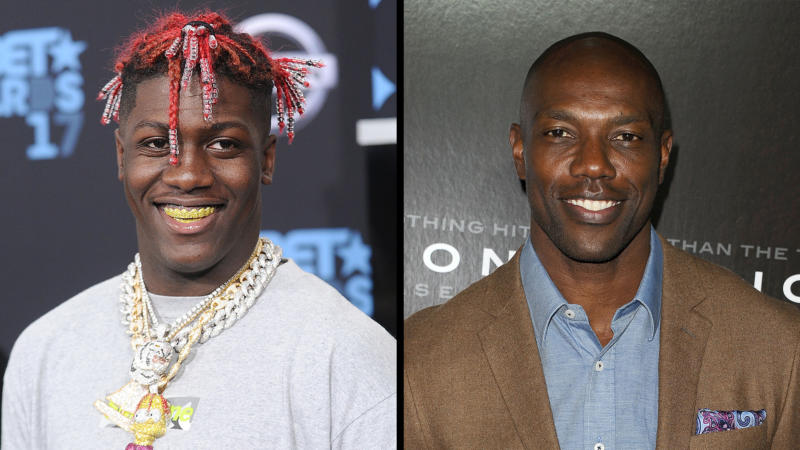

Lil Yachty and Terrell Owens are back to investing, and this time around they’re getting in on the $1.5 trillion wellness industry that’s booming with innovation. A press release reports that PlantFuel® — the scientifically focused plant-based wellness company — announced that both Yachty and Owens have made strategic investments in the emerging sports nutrition brand debuting on the market this month. With support from these two Hip-Hop and sports figures, respectively, the brand aims to breakthrough into the nutritional retail space. “I’m super excited about my new venture with PlantFuel,” Yachty shared in a statement. “It’s brands like PlantFuel that inspire and allow me to stay actively involved creatively beyond just investing.” The new investment in PlantFuel marks Yachty’s second deal ever with his recently-launched venture capital (VC) fund, Scoop Investments. Prior to this news, AfroTech reported that the rapper previously invested in Jewish dating app Lox Club, alongside...

Kevin Durant’s investing power has reached a whole new level as his latest investment is setting him up for more success. According to a report from Sportico, Durant’s investment vehicle, Thirty Five Ventures, participated in a $200 million Series F funding round for health tracking firm WHOOP, which has brought the company’s valuation to $3.6 billion. The new appraisal reportedly will result in a nearly 2,800% return for Durant and his investment firm, topping off yet another successful backing. Sportico also reports that Durant first invested in the health tracking company back in 2017, and just a year later the firm was pegged at a valuation of $125 million. So to see that number now skyrocket to the billion-dollar club means an incredible payoff for the two-time NBA champ’s investment arm. Since early last year, Durant has been busy capitalizing on his success off the court through the development of Thirty Five Ventures — which has made 39 investments to date, according to...

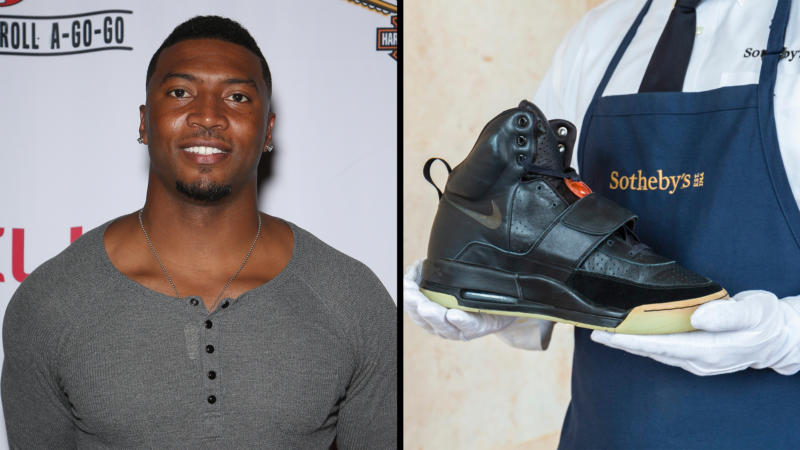

For former NFL player Gerome Sapp, transitioning from the world of professional sports to the world of business came with ease once he found the right concept. After retiring from the league in 2008, he was inspired to start a new career as a tech founder, and his latest conquest in the industry is proving to be quite a force in the investment space. With his driven mindset and finance background, the athlete-turned entrepreneur came up with an innovative concept to educate his community on what it means to make smart investments in assets that especially resonate with them — sneakers. This simple yet revolutionary idea is what paved the way for his new fintech startup Rares — a product of the Techstars Los Angeles Accelerator program — to launch as a platform to help people to invest in shares of particularly notable sneakers. The business, which launched earlier this year, was born amid the pandemic and gave Sapp the opportunity to combine his two passions — the Stock Market and...

Global online sports retailer Fanatics has reached a whopping valuation of $18 billion thanks to some big time investors. CNBC reports that the sports e-commerce merchandise company has secured an additional $325 million in its latest round of funding to help expand its online offerings. Some of its many investors include Jay-Z and the rapper’s entertainment company, Roc Nation. Other major investments in the platform come from companies like MLB, SoftBank, Silver Lake, Eldridge, TWG Sports Media & Entertainment, and Insight Partners. According to The Wall Street Journal, Fanatics says that it expects to rake in $3.4 billion in revenue this year — a major increase from $2.6 billion in 2020 — and with its new valuation it may just reach that goal. For everyone involved, including Jay-Z, an investment in Michael Rubin’s Fanatics could mean supporting the future of sports merch as we know it beyond apparel and memorabilia. The company’s next move is to transform itself into a digital...

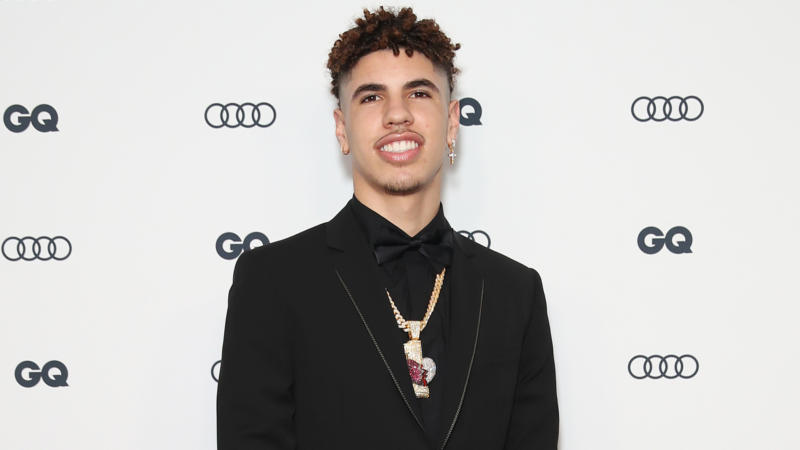

Charlotte Hornets NBA player LaMelo Ball is planning some major investments to give back to his local basketball community, starting with the youth. According to the Charlotte Observer, the 2021 Rookie of the Year player is making moves to start his own high school basketball team in the North Carolina town to help grow and expand the game for future young basketball players. The outlet shares that Ball is partnering with basketball facility Carolina Courts to launch the “1 of 1 Prep Academy” for any and all up-and-coming basketball players in the coming months, in addition to a travel team. As a brand ambassador for Puma, both of Ball’s teams will be sponsored by the athleisure brand. Ball’s investments by way of the upgraded practice facility will put these local student athletes in a position to have access to some of the best resources in the world. Ball’s academy solely focuses on the sport with no formal classes, so players that opt to sign up for his academy will have to give...

Harlem Capital, a diversity -focused venture capital firm, led a $3.7 million seed round for Singuli, according a press release provided to AfroTech. Founded in 2019 by Benjamin Kelly and Thierry Bertin-Mahieux, Singuli created an AI-powered platform that allows retailers to use consumer behavior to better inform inventory decisions. This seed round is the first major funding deal the company has closed, which includes participation from High Alpha Capital, AVG Basecamp Fund, existing investors Interlace Ventures and LAUNCH, as well as angel investors Paul Goodman and Darwish Gani. The fresh funding also includes a previously unannounced $700,000 pre-seed round. “Our mission is to provide commerce brands of all sizes with state of the art tools to make optimal inventory decisions,” Singuli co-founder and CEO Benjamin Kelly told AfroTech. “This is a gnarly space and there are lots of tricky problems.” Kelly was inspired to launch Singuli with Bertin-Mahieux after working as a data...

This athletic apparel line is headed down the fast track to success! According to PR Newswire, Courtsmith — a fast-growing fashion forward sportswear brand — has officially closed a $300,000 equity investment from ICA’s Growth Fund. What makes Courtsmith an emerging leader in the athletic apparel industry is the fact that it is a high-tech sportswear brand and a lifestyle brand too. The company aims to connect both form and function by designing athletic wear that catches the eye of both athletes and casual consumers. Founded by Courtney “Court” Smith, the company first made headlines when it became the official sportswear line for team uniforms and basketball apparel for local youth teams. According to the press release, “ICA’s $300K equity investment is structured as a convertible note and leads Courtsmith’s $575,000 round.” The funds will help expand its marketing efforts, the manufacturing of its clothing and more. Along with the new ICA investment, the brand is set to launch a...

Fresh off her winning weekend at the BET Awards, Megan Thee Stallion is spreading the wealth to teach her fans about investing. Today, the “Hot Girl” rapper announced that she’s teaming up with money giant Cash App to give away $1 million worth of stock to fans in an effort to show them how they can use investments to increase their finances. “Me and my thriving empire, Hot Girl Enterprises, have teamed up with Cash App to teach you everything I learned on the way up about money and how you can build your own empire,” she shared in the first clip of her educational video series called “Investing for Hotties.” “Buying stocks isn’t only for the big players,” she adds. “Anyone can start with as little as $1. Putting in a little money and seeing how it moves is a great way to learn about the stock market and start building up a portfolio.” She also posted about the giveaway on her social media pages writing. “Listen up, Hot Girl CEO and @CashApp are here to teach you about investing. To...